What will be the basic kinds of insurance? What is their role in risk management? To know about the different sorts of insurance, continue reading.

Life today, is filled with risks and adventures on the whole thing. As man has begun interfering with nature, rental destruction have started frequenting. The speedy and stressful life with this competitive world has changed into a cause with the decline within the overall health of folks. Loss of life and property has grown to be common. With the changing times, involve risk management has grown, thus improving the requirement for the insurance plan of life and property and also other needful resources.

Insurance is a great way of risk management and it is defined as an equitable transfer on the risk of a loss of revenue in exchange of the premium. Every quantifiable risk may be insured.

Basic Types of Insurance

Health

Health coverage cover the expenses of topical treatments for various forms of diseases that threaten human life. Disability insurance policies are considered as a different sort of insurance that is aimed at providing financial support to your physically disabled individuals in society. Casualty insurance plans cover accidents.

Life

Life is priceless. However, you will discover measures to 'insure' it. Life insurance coverage provide a monetary benefit towards the descendants in the deceased individual. They also focus on providing the insured person's family with burial and funeral expenses.

Property

Property insurance insures property, thus protecting it against threats like fire, theft, or damage because of harsh climate.

Credit

Credit insurance plans are for the purpose of the repayment of loans regarding death, disability, or unemployment with the borrower.

Other Types

Accidental Death and Dismemberment Insurance

This insurance covers death and injury that comes from accidents. Death that is a result of illness, suicide, or natural reasons will not be covered under a renters insurance policy.

Automobile Insurance

Also called, vehicle insurance, it covers the danger borne in traffic accidents and liabilities which could result from accidents.

Guaranteed Asset Protection insurance (GAP) comes supplemented with automobile coverage. The losses that vehicle insurance plans do not cover are handled from the accompanying GAP insurances.

Public auto insurance policies are an vehicle insurance scheme belonging to the government. It mainly operates in British Colombia, Manitoba, and Quebec.

Boiler Insurance

It indemnifies the insured up against the expenses that will have to become borne for your repair or replacing of home boilers plus the plumbing, heating, and electric systems with the household.

Bond Insurance

In this insurance service, the link issuers will pay the premiums with a third party in the case of failure on part in the issuer. In such cases, the alternative provides the interest and capital repayments prescribed by the web link.

Business Overhead Expense Disability Insurance

The one that is insured by a renters insurance policy manages the likelihood of his/her disability by arranging the insurer authority to deal with the business overhead expenses in case from the business entrepreneur's disability. Business insurance plans are an excellent way to insure an enterprise.

Casualty Insurance

It covers the loss that comes from an accident. It may bear the expenses on the vehicle loss or the expenses incurred in restoring the damages caused by accident. Casualty insurance coverage do not cover life, health, and property losses.

Catastrophe Bond

These bonds are made to transfer the responsibility of your certain pair of risks from your sponsors on the investors.

Chargeback Insurance

This insurance policies are meant to the business merchants who accept cards. When accepting plastic cards for purchases involving large money transactions, merchants risk their business. Fraudulent behavior on part from the credit cardholder or use of unauthorized or invalid charge cards puts the merchant's money threatened. Chargeback insurance coverage protect the merchants readily available risks.

Contents Insurance

It covers the loss or damage for the personal possessions of your individual when they are located in one's home. The insurance may additionally cover the possessions kept inside the exterior of one's household, including things residing in one's garden area. These insurance coverage find utility for those renting houses. It is generally purchased in collaboration using a home insurance coverage.

Corporate-owned Life Insurance

The employing companies hold this insurance for within the sudden losses in their employees. Originally, these insurances were held by companies to protect the risk from the death of these key employees. This insurance insures the price incurred about the recruitment and training arrangements that need to be made regarding an unexpected death of any from the company employees.

Credit Insurance

Credit coverage are made to compensate for credit risks operating.

Crime Insurance

Employee thefts and offenses causing financial losses to some business are covered under crime insurance coverage. Crime insurance may be used to pay for the damage brought on by crimes like murders and rapes.

Critical Illness Insurance

Critical illness coverage prescribe a set of diseases to get grouped underneath the class of critical ones. The policyholders are insured in the event of being suffering from any with the diseases enlisted as critical within the policy. The policy can be structured to produce the client with regular payments or maybe a lump sum amount on being informed they have one on the critical illnesses.

Crop Insurance

Agricultural producers purchase this insurance to guard themselves against a loss of revenue or problems for their crops on account of earthquakes or revenue losses.

Dental Insurance

It is categorized in the class of health insurances and is particularly meant to pay the price incurred on dentistry. Considering the increasingly expensive dental treatments, dental plans form a crucial section of health insurances today.

Deposit Insurance

These insurances protect the deposits in event of bank runs. A bank run has been said to occur every time a large number of customers of the bank withdraw their deposits from your bank. Deposit insurance is aimed at covering the chance of running into this sort of financial crisis.

Disability Insurance

Disability insurance covers the client's earnings against the danger that a disability might make working impossible for him/her. Disability plans are arrangements to secure one's future if the individual is can not work and earn.

Earthquake Insurance

It is a style of property insurance, which takes care of the risks borne by houses caused by frequently occurring earthquakes. It insures the destruction caused to property caused by earthquakes. It is trusted in Japan and California.

Expatriate Insurance

This insurance covers the losses that certain may have to have problems with, while residing and dealing in a non-native country. An expatriate insurance plan has being purchased before one relocates abroad. It covers the time of stay inside non-native country.

Fidelity Bond

These bonds function as protection for a small business from the fraudulent behavior of the employees.

Flood Insurance

It covers the damages to property that derive from floods. Around 20% with the households from the United States are insured for flood, because they are susceptible to them.

General Insurance

General insurance schemes include policies for automobiles, homeowners and precisely any insurance which doesn't fall under term life insurance. General coverage cover losses caused by certain financial events.

Group Insurance

It covers the health risks borne using a group of people. Group coverage are generally purchased for the group of members of any society or maybe a group of professionals in a organization. It is less costly than individual insurance coverage.

Health Insurance

The expenses incurred on treating physical disabilities, long-term nursing and custodial care are covered under medical care insurance schemes. Health coverage insure the installments for medical care bills.

Home Insurance

It insures the losses incurred on restoring the damages due to hazards to households. Home insurance plans cover losses with the personal possessions of house owners.

Perpetual insurance coverage is a way of home insurance the place that the coverage is valid for perpetuity and this the policy doesn't have a designated date of expiry.

Injury Cover

It includes the compensations for work-related injuries. It may be used along with medical insurance, workers' compensation, or compensation for injuries services.

Keyman Insurance

Keyman insurance policies is the one purchased using a businessman to secure the possibility losses of his resources and cover the incapacity or death of any key employee. Keyman insurance protects you from your greatest of business risks.

Landlords Insurance

It is designed to protect the property owners from threats like fire, earthquake, and floods as also thefts which can be potential dangers for their property.

Lenders Mortgage Insurance

It compensates with the losses incurred through the lender in the event the mortgager is struggling to repay the money or when the financial institution in not able to compensate for that lent amount despite the sale in the mortgaged property.

Liability Insurance

It might be called a part on the general insurance system that handle risk financing. It typically necessitates the payment for the third party suffering from a loss of revenue and not for the insured party.

Life Insurance

Under life insurance coverage schemes, the policyholder and the plan owner contract in line with which the insurer is liable to pay a particular amount of money in case there is death or terminal illness on the insured individual.

Whole life insurance policies are a life insurance policies that remains in force through the life from the insured individual as well as him/her to pay for premiums annually.

Pension term insurance plan is a kind of life insurance that is certainly popular would be the United Kingdom. After 2006, once the policyholders were offered tax benefits for the premiums they paid, pension term insurance coverage gained wide popularity.

Permanent life insurance coverage refers with a life insurance policies, which is for your life on the insured individual.

Term life insurance policies is purchased to get a specific period and the plan amount is paid for the beneficiary in event from the death from the insured through the specific period.

Return of premium life insurance plan is a kind of term life insurance policies wherein the premiums are returned after having a stipulated period of time if the policyholder will not use the coverage during that period.

Stranger originated life insurance plan is initiated by a individual that bears no relation with all the person for whom the insurance policy is being obtained. The stranger offers to pay for the premiums contrary to the insured person's everyday life.

Universal life insurance coverage is a permanent term life insurance that is dependant on cash value. It might be used for tax benefits. Variable Universal life insurance policies are a similar insurance scheme that builds cash value. It allows the policyholder to get different accounts.

Loan Protection Insurance

It secures somebody in terms of his/her loan payments if the individual should go through a time of unemployment in the time with the payment of his dues.

Locked Funds Insurance

Banks and governments issue locked fund insurance coverage in collaboration with the other person. These policies protect public funds from being manipulated by unauthorized parties.

Long-term Care Insurance

It targets providing the insured individuals to get a long-term care and covers the costs, that are not included in health coverage or Medicare.

Marine Insurance

It covers the losses incurred in problems for ships, terminals and then for any property that may be transported through cargo. Inland marine insurance, which can be closely connected with marine insurance, secures the moving or movable property of the individual.

Medigap

It comprises private supplemental medical care insurance plans, which can be purchased by people with the United States. It covers the price beyond those borne by Medicare.

Mortgage Life Insurance

This covers repayment mortgage, referring with a mortgage during which monthly repayments imply the repayment from the capital together with the accumulated interest.

Mutual Insurance

The mutual insurance policyholders have a clear amount of ownership rights from the organization. Those protected by the insurance plan possess the rights to elect the corporation management and take part from the distribution of net assets if your organization stops doing work.

No-fault Insurance

In this form associated with an insurance contract, the insurer covers the losses by the insurance coverage company irrespective on the party responsible to the losses.

Parametric Insurance

Parametric coverage define a binding agreement between the policyholder plus the issuer in line with which the issuer agrees to pay some amount of money on the insured inside the event of an natural disaster.

Payment Protection Insurance

These policies insure the repayment of debts when the insured has unemployment on account of a car accident or illness and doesn't repay his/her loan.

Pet Insurance

Pet insurance plans cover the expenses incurred for treating a pet's illness. Some pet insurance plans also cover the losses borne from the pet owner in event on the death or theft on the pet.

Political Risk Insurance

Political risk plans cover the political risks to businesses. Political violence like riots, terrorism and war, and governmental arrogation are called political risks to business.

Pre-paid Legal Services

It refers to some scheme wherein somebody pays a monthly fee which is entitled to access quite a few legal services on call. Individuals are charged for many services like monthly legal counsel and consultation. As the insurer commission takes care of the pre-paid legal services, they're classified beneath the different varieties of insurance.

Professional Indemnity Insurance

It secures the policyholder against losses incurred as a result of an negligent act inside policyholder's business. Professional indemnity insurance also covers the loss that may result from claims for that policyholder's breach of duty and in addition indemnifies the policyholder up against the policyholder's civil liability. It is also called professional liability insurance.

Property Insurance

It indemnifies the policyholder resistant to the risks to his/her property. Insurances covering fire, flood, and earthquake threats as also home insurances are special varieties of property insurance.

Protection and Indemnity Insurance

It is often a marine insurance that protects the insured from vacation liabilities as a result of owning ships.

Reinsurance

Reinsurance isn't exactly a kind of insurance but is quite a means in which insurance companies safeguard themselves from the probability of losses with other insurance agencies. Reinsurers provide the insurance coverage companies with insurance. Even insurances need for being insured.

Rent Guarantee

Landlord rent guarantee insurance and legal assistance insurance together cover the expenses incurred through the landlords in recovering their rent or even in taking legal action up against the tenants failing to pay for their rents.

Self-insurance

It is a means of risk management wherein a clear amount of cash is set aside to shield one's future. Self-insurance involves putting away an amount that will cover for your unexpected losses later on.

Self-funded heath care treatment refers to your self-insurance which is provided by a company to his/her employees in assumption of an risk in paying their claims for benefits.

Terrorism Insurance

The potential losses that might be caused caused by terrorist activities are covered under terrorism insurance. Terrorist attacks are almost unpredictable and intensely perilous. This has led people in many parts from the world to secure themselves against terrorism.

Title Insurance inside the United States

It indemnifies somebody against financial losses that may originate from defects in title to real estate. The losses incurred from invalid mortgages can also be covered under title insurance coverage. Title insurance plans are a kind of insurance that protects the property owner or lender. Commonly regarding closing costs for the settlement of your house or property, real estate property title insurance contains two distinct phases. During the first phase, the title company actively works to define the boundaries from the real estate being purchased as well as conducts specific searches that determines the status from the property regarding unpaid real estate investment taxes as well as other claims. In the second phase, throughout the term in the mortgage, the title company protects both the master and the bank from financial loss due to problems with all the title that could arise caused by unexpected property claims which can be not excluded with the policy.

Travel Insurance

Long journeys come using a risk. The insurance purchased to compensate for that losses throughout a travel is referred to as travel insurance. It covers medical expenses and financial losses and refers to journeys within one's country and abroad.

Vision Insurance

On lines similar to dental insurance plan, vision insurance covers the price one may have in contact in eye treatments and services written by ophthalmologists.

Wage Insurance

This can be a proposed sort of insurance, that's intended to produce workers with compensation in case these are compelled to maneuver to jobs with lower salaries.

War Risk Insurance

War risk insurance plans cover the losses one may need to incur inside the event of war. The war risks include invasion, rebellion, hijacking and might also include the threats from weapons that create massive destruction of life and property.

Workers' Compensation

It is intended to supply the company employees with monetary compensations in case they may be injured in the workplace. Workers' compensation could be given inside the form of reimbursement of medical bills, weekly wages, or benefits to your employee's dependents.

Insurance is in the end an attempt to make amends for grave losses in in addition to life. But can anything be 'insured' inside the real sense? Can compensations heal the grief of loss? Surely, compensations cannot substitute life.

Life today, is filled with risks and adventures on the whole thing. As man has begun interfering with nature, rental destruction have started frequenting. The speedy and stressful life with this competitive world has changed into a cause with the decline within the overall health of folks. Loss of life and property has grown to be common. With the changing times, involve risk management has grown, thus improving the requirement for the insurance plan of life and property and also other needful resources.

Insurance is a great way of risk management and it is defined as an equitable transfer on the risk of a loss of revenue in exchange of the premium. Every quantifiable risk may be insured.

Basic Types of Insurance

Health

Health coverage cover the expenses of topical treatments for various forms of diseases that threaten human life. Disability insurance policies are considered as a different sort of insurance that is aimed at providing financial support to your physically disabled individuals in society. Casualty insurance plans cover accidents.

Life

Life is priceless. However, you will discover measures to 'insure' it. Life insurance coverage provide a monetary benefit towards the descendants in the deceased individual. They also focus on providing the insured person's family with burial and funeral expenses.

Property

Property insurance insures property, thus protecting it against threats like fire, theft, or damage because of harsh climate.

Credit

Credit insurance plans are for the purpose of the repayment of loans regarding death, disability, or unemployment with the borrower.

Other Types

Accidental Death and Dismemberment Insurance

This insurance covers death and injury that comes from accidents. Death that is a result of illness, suicide, or natural reasons will not be covered under a renters insurance policy.

Automobile Insurance

Also called, vehicle insurance, it covers the danger borne in traffic accidents and liabilities which could result from accidents.

Guaranteed Asset Protection insurance (GAP) comes supplemented with automobile coverage. The losses that vehicle insurance plans do not cover are handled from the accompanying GAP insurances.

Public auto insurance policies are an vehicle insurance scheme belonging to the government. It mainly operates in British Colombia, Manitoba, and Quebec.

Boiler Insurance

It indemnifies the insured up against the expenses that will have to become borne for your repair or replacing of home boilers plus the plumbing, heating, and electric systems with the household.

Bond Insurance

In this insurance service, the link issuers will pay the premiums with a third party in the case of failure on part in the issuer. In such cases, the alternative provides the interest and capital repayments prescribed by the web link.

Business Overhead Expense Disability Insurance

The one that is insured by a renters insurance policy manages the likelihood of his/her disability by arranging the insurer authority to deal with the business overhead expenses in case from the business entrepreneur's disability. Business insurance plans are an excellent way to insure an enterprise.

Casualty Insurance

It covers the loss that comes from an accident. It may bear the expenses on the vehicle loss or the expenses incurred in restoring the damages caused by accident. Casualty insurance coverage do not cover life, health, and property losses.

Catastrophe Bond

These bonds are made to transfer the responsibility of your certain pair of risks from your sponsors on the investors.

Chargeback Insurance

This insurance policies are meant to the business merchants who accept cards. When accepting plastic cards for purchases involving large money transactions, merchants risk their business. Fraudulent behavior on part from the credit cardholder or use of unauthorized or invalid charge cards puts the merchant's money threatened. Chargeback insurance coverage protect the merchants readily available risks.

Contents Insurance

It covers the loss or damage for the personal possessions of your individual when they are located in one's home. The insurance may additionally cover the possessions kept inside the exterior of one's household, including things residing in one's garden area. These insurance coverage find utility for those renting houses. It is generally purchased in collaboration using a home insurance coverage.

Corporate-owned Life Insurance

The employing companies hold this insurance for within the sudden losses in their employees. Originally, these insurances were held by companies to protect the risk from the death of these key employees. This insurance insures the price incurred about the recruitment and training arrangements that need to be made regarding an unexpected death of any from the company employees.

Credit Insurance

Credit coverage are made to compensate for credit risks operating.

Crime Insurance

Employee thefts and offenses causing financial losses to some business are covered under crime insurance coverage. Crime insurance may be used to pay for the damage brought on by crimes like murders and rapes.

Critical Illness Insurance

Critical illness coverage prescribe a set of diseases to get grouped underneath the class of critical ones. The policyholders are insured in the event of being suffering from any with the diseases enlisted as critical within the policy. The policy can be structured to produce the client with regular payments or maybe a lump sum amount on being informed they have one on the critical illnesses.

Crop Insurance

Agricultural producers purchase this insurance to guard themselves against a loss of revenue or problems for their crops on account of earthquakes or revenue losses.

Dental Insurance

It is categorized in the class of health insurances and is particularly meant to pay the price incurred on dentistry. Considering the increasingly expensive dental treatments, dental plans form a crucial section of health insurances today.

Deposit Insurance

These insurances protect the deposits in event of bank runs. A bank run has been said to occur every time a large number of customers of the bank withdraw their deposits from your bank. Deposit insurance is aimed at covering the chance of running into this sort of financial crisis.

Disability Insurance

Disability insurance covers the client's earnings against the danger that a disability might make working impossible for him/her. Disability plans are arrangements to secure one's future if the individual is can not work and earn.

Earthquake Insurance

It is a style of property insurance, which takes care of the risks borne by houses caused by frequently occurring earthquakes. It insures the destruction caused to property caused by earthquakes. It is trusted in Japan and California.

Expatriate Insurance

This insurance covers the losses that certain may have to have problems with, while residing and dealing in a non-native country. An expatriate insurance plan has being purchased before one relocates abroad. It covers the time of stay inside non-native country.

Fidelity Bond

These bonds function as protection for a small business from the fraudulent behavior of the employees.

Flood Insurance

It covers the damages to property that derive from floods. Around 20% with the households from the United States are insured for flood, because they are susceptible to them.

General Insurance

General insurance schemes include policies for automobiles, homeowners and precisely any insurance which doesn't fall under term life insurance. General coverage cover losses caused by certain financial events.

Group Insurance

It covers the health risks borne using a group of people. Group coverage are generally purchased for the group of members of any society or maybe a group of professionals in a organization. It is less costly than individual insurance coverage.

Health Insurance

The expenses incurred on treating physical disabilities, long-term nursing and custodial care are covered under medical care insurance schemes. Health coverage insure the installments for medical care bills.

Home Insurance

It insures the losses incurred on restoring the damages due to hazards to households. Home insurance plans cover losses with the personal possessions of house owners.

Perpetual insurance coverage is a way of home insurance the place that the coverage is valid for perpetuity and this the policy doesn't have a designated date of expiry.

Injury Cover

It includes the compensations for work-related injuries. It may be used along with medical insurance, workers' compensation, or compensation for injuries services.

Keyman Insurance

Keyman insurance policies is the one purchased using a businessman to secure the possibility losses of his resources and cover the incapacity or death of any key employee. Keyman insurance protects you from your greatest of business risks.

Landlords Insurance

It is designed to protect the property owners from threats like fire, earthquake, and floods as also thefts which can be potential dangers for their property.

Lenders Mortgage Insurance

It compensates with the losses incurred through the lender in the event the mortgager is struggling to repay the money or when the financial institution in not able to compensate for that lent amount despite the sale in the mortgaged property.

Liability Insurance

It might be called a part on the general insurance system that handle risk financing. It typically necessitates the payment for the third party suffering from a loss of revenue and not for the insured party.

Life Insurance

Under life insurance coverage schemes, the policyholder and the plan owner contract in line with which the insurer is liable to pay a particular amount of money in case there is death or terminal illness on the insured individual.

Whole life insurance policies are a life insurance policies that remains in force through the life from the insured individual as well as him/her to pay for premiums annually.

Pension term insurance plan is a kind of life insurance that is certainly popular would be the United Kingdom. After 2006, once the policyholders were offered tax benefits for the premiums they paid, pension term insurance coverage gained wide popularity.

Permanent life insurance coverage refers with a life insurance policies, which is for your life on the insured individual.

Term life insurance policies is purchased to get a specific period and the plan amount is paid for the beneficiary in event from the death from the insured through the specific period.

Return of premium life insurance plan is a kind of term life insurance policies wherein the premiums are returned after having a stipulated period of time if the policyholder will not use the coverage during that period.

Stranger originated life insurance plan is initiated by a individual that bears no relation with all the person for whom the insurance policy is being obtained. The stranger offers to pay for the premiums contrary to the insured person's everyday life.

Universal life insurance coverage is a permanent term life insurance that is dependant on cash value. It might be used for tax benefits. Variable Universal life insurance policies are a similar insurance scheme that builds cash value. It allows the policyholder to get different accounts.

Loan Protection Insurance

It secures somebody in terms of his/her loan payments if the individual should go through a time of unemployment in the time with the payment of his dues.

Locked Funds Insurance

Banks and governments issue locked fund insurance coverage in collaboration with the other person. These policies protect public funds from being manipulated by unauthorized parties.

Long-term Care Insurance

It targets providing the insured individuals to get a long-term care and covers the costs, that are not included in health coverage or Medicare.

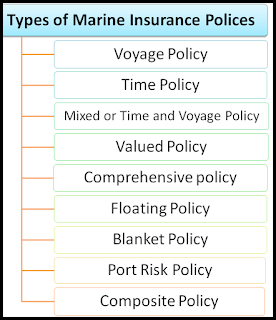

Marine Insurance

It covers the losses incurred in problems for ships, terminals and then for any property that may be transported through cargo. Inland marine insurance, which can be closely connected with marine insurance, secures the moving or movable property of the individual.

Medigap

It comprises private supplemental medical care insurance plans, which can be purchased by people with the United States. It covers the price beyond those borne by Medicare.

Mortgage Life Insurance

This covers repayment mortgage, referring with a mortgage during which monthly repayments imply the repayment from the capital together with the accumulated interest.

Mutual Insurance

The mutual insurance policyholders have a clear amount of ownership rights from the organization. Those protected by the insurance plan possess the rights to elect the corporation management and take part from the distribution of net assets if your organization stops doing work.

No-fault Insurance

In this form associated with an insurance contract, the insurer covers the losses by the insurance coverage company irrespective on the party responsible to the losses.

Parametric Insurance

Parametric coverage define a binding agreement between the policyholder plus the issuer in line with which the issuer agrees to pay some amount of money on the insured inside the event of an natural disaster.

Payment Protection Insurance

These policies insure the repayment of debts when the insured has unemployment on account of a car accident or illness and doesn't repay his/her loan.

Pet Insurance

Pet insurance plans cover the expenses incurred for treating a pet's illness. Some pet insurance plans also cover the losses borne from the pet owner in event on the death or theft on the pet.

Political Risk Insurance

Political risk plans cover the political risks to businesses. Political violence like riots, terrorism and war, and governmental arrogation are called political risks to business.

Pre-paid Legal Services

It refers to some scheme wherein somebody pays a monthly fee which is entitled to access quite a few legal services on call. Individuals are charged for many services like monthly legal counsel and consultation. As the insurer commission takes care of the pre-paid legal services, they're classified beneath the different varieties of insurance.

Professional Indemnity Insurance

It secures the policyholder against losses incurred as a result of an negligent act inside policyholder's business. Professional indemnity insurance also covers the loss that may result from claims for that policyholder's breach of duty and in addition indemnifies the policyholder up against the policyholder's civil liability. It is also called professional liability insurance.

Property Insurance

It indemnifies the policyholder resistant to the risks to his/her property. Insurances covering fire, flood, and earthquake threats as also home insurances are special varieties of property insurance.

Protection and Indemnity Insurance

It is often a marine insurance that protects the insured from vacation liabilities as a result of owning ships.

Reinsurance

Reinsurance isn't exactly a kind of insurance but is quite a means in which insurance companies safeguard themselves from the probability of losses with other insurance agencies. Reinsurers provide the insurance coverage companies with insurance. Even insurances need for being insured.

Rent Guarantee

Landlord rent guarantee insurance and legal assistance insurance together cover the expenses incurred through the landlords in recovering their rent or even in taking legal action up against the tenants failing to pay for their rents.

Self-insurance

It is a means of risk management wherein a clear amount of cash is set aside to shield one's future. Self-insurance involves putting away an amount that will cover for your unexpected losses later on.

Self-funded heath care treatment refers to your self-insurance which is provided by a company to his/her employees in assumption of an risk in paying their claims for benefits.

Terrorism Insurance

The potential losses that might be caused caused by terrorist activities are covered under terrorism insurance. Terrorist attacks are almost unpredictable and intensely perilous. This has led people in many parts from the world to secure themselves against terrorism.

Title Insurance inside the United States

It indemnifies somebody against financial losses that may originate from defects in title to real estate. The losses incurred from invalid mortgages can also be covered under title insurance coverage. Title insurance plans are a kind of insurance that protects the property owner or lender. Commonly regarding closing costs for the settlement of your house or property, real estate property title insurance contains two distinct phases. During the first phase, the title company actively works to define the boundaries from the real estate being purchased as well as conducts specific searches that determines the status from the property regarding unpaid real estate investment taxes as well as other claims. In the second phase, throughout the term in the mortgage, the title company protects both the master and the bank from financial loss due to problems with all the title that could arise caused by unexpected property claims which can be not excluded with the policy.

Travel Insurance

Long journeys come using a risk. The insurance purchased to compensate for that losses throughout a travel is referred to as travel insurance. It covers medical expenses and financial losses and refers to journeys within one's country and abroad.

Vision Insurance

On lines similar to dental insurance plan, vision insurance covers the price one may have in contact in eye treatments and services written by ophthalmologists.

Wage Insurance

This can be a proposed sort of insurance, that's intended to produce workers with compensation in case these are compelled to maneuver to jobs with lower salaries.

War Risk Insurance

War risk insurance plans cover the losses one may need to incur inside the event of war. The war risks include invasion, rebellion, hijacking and might also include the threats from weapons that create massive destruction of life and property.

Workers' Compensation

It is intended to supply the company employees with monetary compensations in case they may be injured in the workplace. Workers' compensation could be given inside the form of reimbursement of medical bills, weekly wages, or benefits to your employee's dependents.

Insurance is in the end an attempt to make amends for grave losses in in addition to life. But can anything be 'insured' inside the real sense? Can compensations heal the grief of loss? Surely, compensations cannot substitute life.